Business Insurance in and around Portage

One of the top small business insurance companies in Portage, and beyond.

No funny business here

Help Protect Your Business With State Farm.

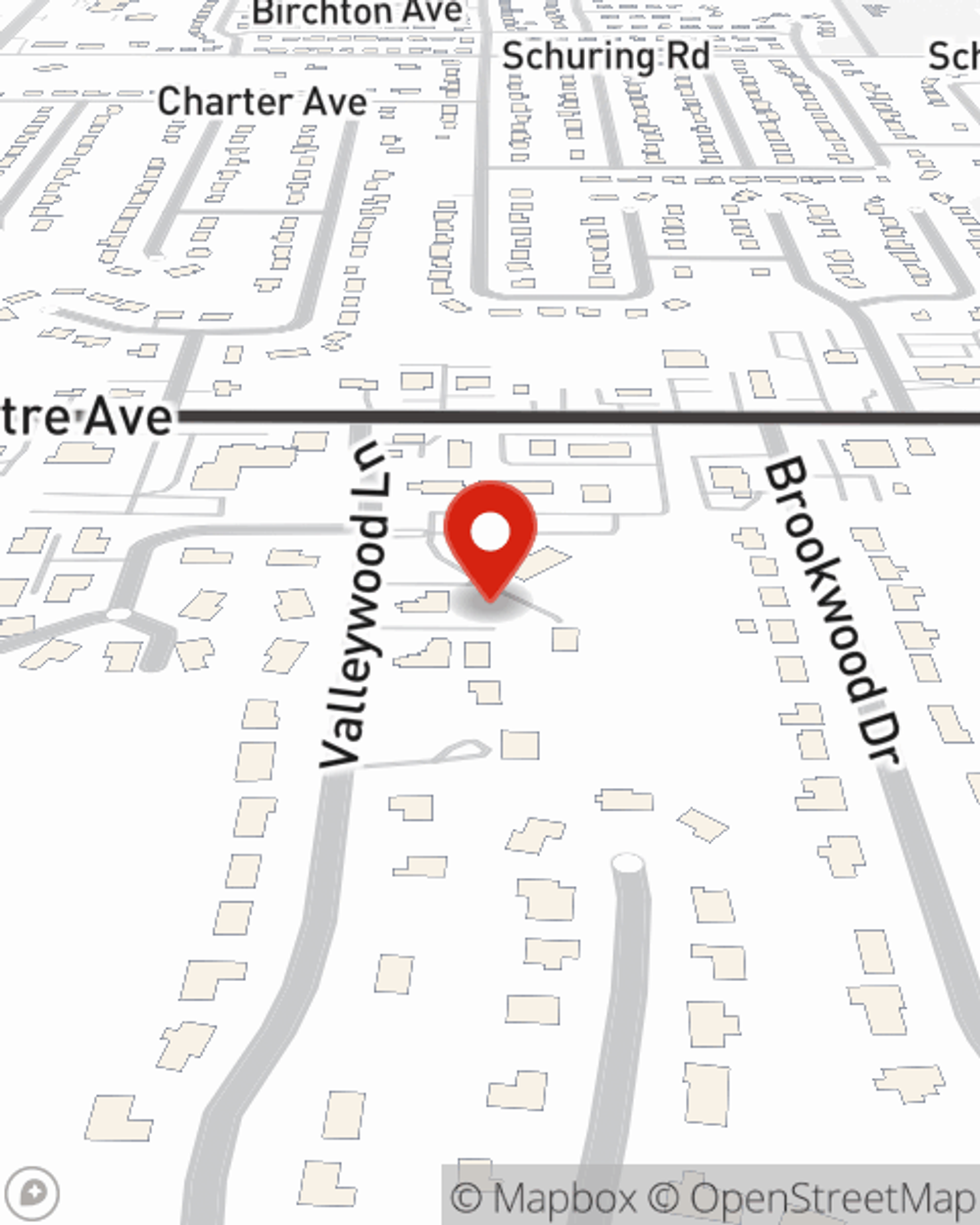

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Barry Dickinson help you learn about quality business insurance.

One of the top small business insurance companies in Portage, and beyond.

No funny business here

Strictly Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your income, but also helps with regular payroll expenses. You can also include liability, which is crucial coverage protecting your financial assets in the event of a claim or judgment against you by a consumer.

It's time to visit State Farm agent Barry Dickinson. You'll quickly distinguish why State Farm is the reliable name for small business insurance.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Barry Dickinson

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.